Fulcrum Energy Capital Funds is a Denver, Colorado-based private investment firm focused on direct lower middle market oil and gas investment opportunities in North America. The Fulcrum funds target privately-negotiated, structured equity, credit, and asset level investments.

Investment Approach

Fulcrum takes a value-oriented approach to upstream investing, primarily creating value through active ownership and unique industry relationships. We seek to take sizeable positions in smaller oil and gas companies, enabling us to influence business strategy and operational efficiency through our in-house technical team. Investments are structured to maintain flexibility through varying market conditions, allowing us to hold investments over a medium-term horizon or exit opportunistically to maximize value for stakeholders.

The Team

The Fulcrum team has extensive experience in upstream oil and gas across investing, land, operations, engineering, and geoscience. This diverse set of technical skillsets helps inform and guide our investments into well-run companies and attractive underlying assets.

Portfolio

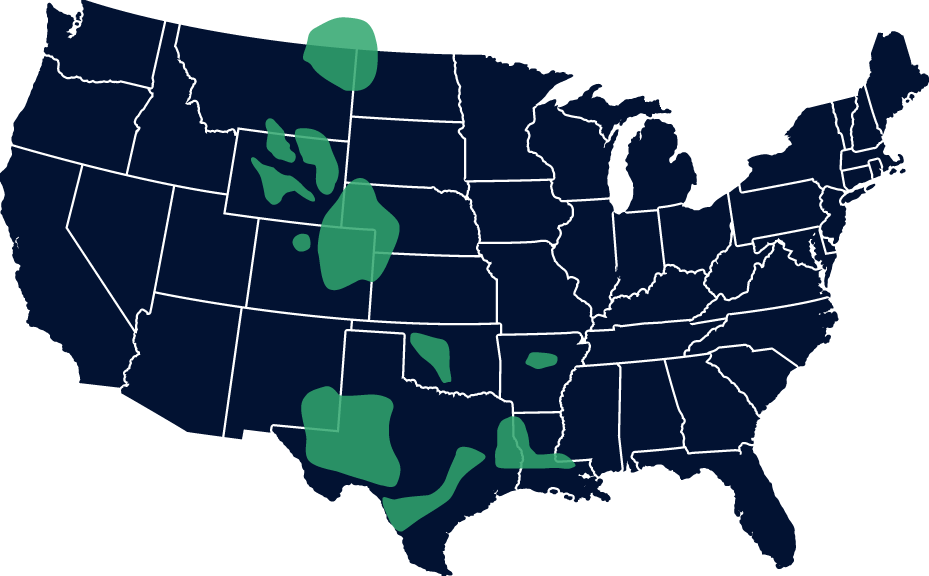

Fulcrum has invested in onshore conventional and unconventional upstream oil and gas assets across the United States along with several select upstream adjacent businesses. The firm operates and manages certain assets in-house on behalf of investors through an affiliate, Fulcrum Energy Operating, LLC.

Current Investment Areas

Interested in Selling?

Fulcrum is actively seeking to acquire operated and non-operated working interests as well as non-operated AFEs in US onshore oil and gas basins. If you’re interested in selling an asset, please contact us here. If you’re interested in another potential form of upstream oil and gas investment, please contact us here.