Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis et finibus enim. Cras vel dui luctus, luctus ex non, molestie lectus. Morbi tempus sodales ultrices. Nulla facilisi. Nullam odio quam, scelerisque in fermentum vitae, fermentum non eros. Vivamus lobortis, diam blandit tempus blandit, elit ipsum viverra tortor, eget consequat purus ipsum mollis ligula. In consequat consectetur rhoncus. Suspendisse placerat sed diam sit amet auctor. Aliquam pellentesque mauris enim, vel venenatis lorem venenatis nec. In placerat suscipit diam, nec fringilla magna ornare nec.

Transaction Type

Hedges

After Investment

Finding Non-Marketed

Relationship Deals

Returning Cash Flow

to Investors

Sell After

~5 Years

- Ability to hedge-in a robust base return, with substantial downside protection

- Pursuing new financings in areas with little access to current capital markets

- Pursuing financings at valuations supported by producing reserves and current cash flow

- Non-marketed relationship deals

- Niche transactions in the distressed and special situations space

- Transactions where the majority of overall invested capital is returned through asset cash flow over a medium-term hold period

Transaction Size

Typical Fulcrum Investment Of

$10 – $25M

with exceptions

Transaction Values Typically Up to

$100M

for initial platform

Opportunity Set

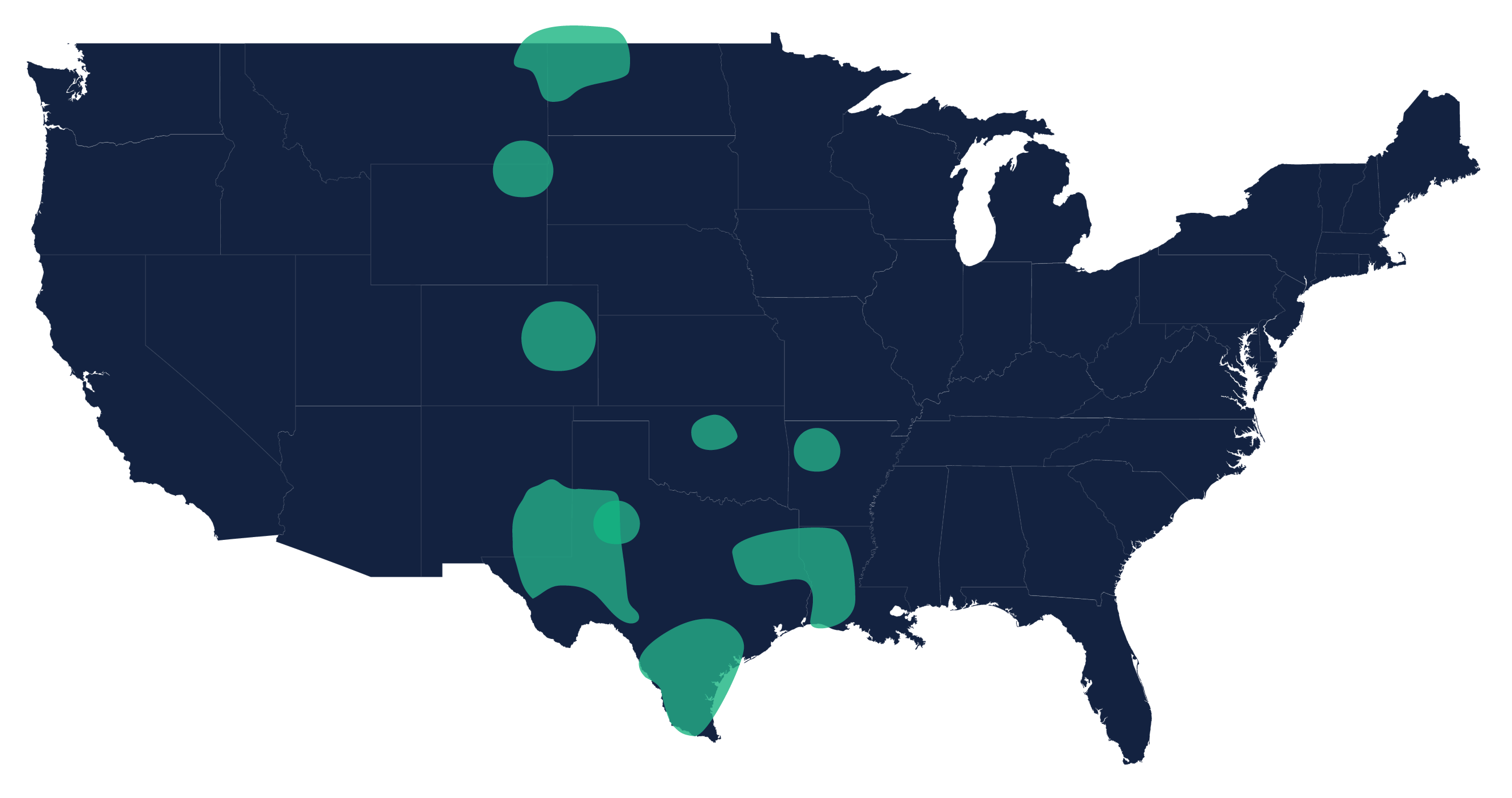

Underserved space in lower middle market oil and gas finance |

Capital intensive industry given asset heavy nature of the business |

Large wave of M&A, debt maturities, and capital requirements on the horizon |

Strategic situations where flexible capital solutions are differentiated and existing capital providers are too large and over-specialized |

Denver is an underserved market for energy private equity capital relative to the number of oil and gas companies in the Rocky Mountain region |

Other Key Criteria