10 Mar Coronavirus / OPEC+ Market Update

Over the last month, oil prices have deteriorated significantly. Natural gas price declines have been less significant and are largely related to supply and demand fundamentals. However, the notable decrease in oil prices has been a result of geopolitical tensions with OPEC+ as well as concerns relating to decreased demand for oil relating to the outbreak of the Coronavirus.

We believe the OPEC and Russia oil price war unequivocally started last weekend when Saudi Arabia aggressively cut the relative price at which it sells its crude by the most in at least 20 years. This completely changes the outlook for the oil and gas markets, in our view, and brings focus to a new dynamic whereby, low cost producers increase supply from their spare capacity to force higher cost producers to reduce output.

While we can’t rule out an OPEC+ deal in coming months, we also believe that this agreement was inherently imbalanced and its production cuts economically unfounded. Assuming no change in production policy, analysts expect a market deficit to start in Q4 2020 and that would run down excess inventories through 2021, with the outlook for draws helping prices rebound that quarter, like they did in the spring of Q2 2016.

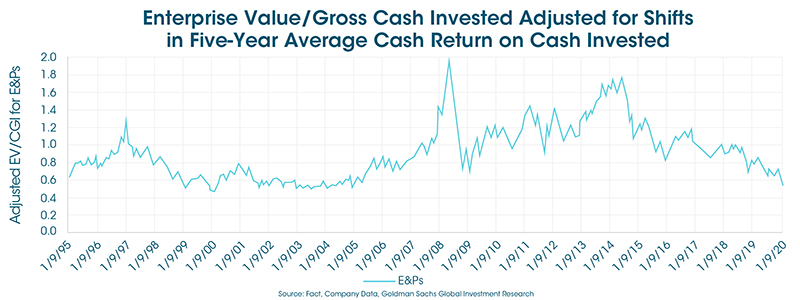

In the public market (as shown in the chart above), E&P stocks since 1995 have historically bottomed around 50 cents on the dollar per dollar invested, adjusted for degradation in five-year forward corporate cash return on cash invested. In recent weeks, valuations have fallen closer toward this level. This does not automatically mean valuations are at bottom but reflect what analysts believe is a clear cyclical negative view priced into the equities, consistent with what is implied on an NAV basis. The same theme is generally present in the private market sector.

From a supply and demand perspective, analysts now base market fundamentals on an OPEC/Russia price war, with sharply rising production starting in Q2 2020 and with higher cost producers gradually responding to the lower price environment. These oil balances shown on the following page indicate demand to equalize with supply in Q4 2020.

This new macroeconomic market dynamic, while bearish initially, will likely start the clock on under-investment, with a clearer line of sight on higher equilibrium prices in the future. Lower prices will likely lead to decreased drilling, increased financial distress in the industry as it relates to companies that are overleveraged and, eventually, we believe that the fittest will survive, and low prices will eventually take care of low prices. Companies with the least leverage and highest quality assets that have low breakeven production costs will be the ones that weather this tough time and take advantage of the distressed investment opportunity during this market cycle.