07 Jan Fulcrum Executing on Top-Quartile M&A

Recognizing attractive acquisitions is an important part of making the most out of any cyclical business, particularly through a prolonged downturn such as the one being experienced in the oil and gas industry.

Purchasing quality assets with favorable metrics allows purchasers to profitably operated them even when commodity prices are low, and maximizes potential upside when prices improve.

At Fulcrum Energy Capital Funds, we always look for attractive acquisition opportunities to maximize the value of our portfolio. Recently, our portfolio company Pachira Oil & Gas closed on an add-on acquisition of assets in the Eagle Ford play of Texas with favorable metrics compared to industry averages.

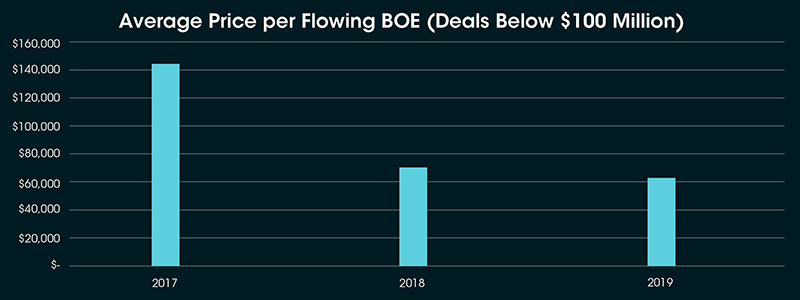

At less than $13,000 per flowing BOE, Pachira’s recent acquisition was in the lowest 20% in terms of cost paid for flowing production compared to M&A deals under $100 million in 2019. This low cost of acquisition on cash-flowing assets in a play which produces crude oil which receives premium pricing allows Pachira to realize attractive returns on capital deployed.

To learn more about M&A in 2019, click here.

Fulcrum’s investment philosophy emphasizes the acquisition of assets that provide healthy returns through their production alone. This strategy allows the firm to maximize possible upside if commodity prices improve through improved cash flow or through a future sale.