25 Sep Fulcrum Market Update: September 2019

CLICK HERE FOR THE FULCRUM MARKET UPDATE

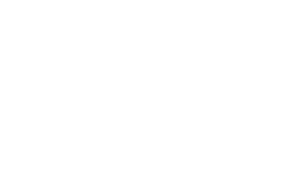

Traditional Sources of Capital Declining for Energy

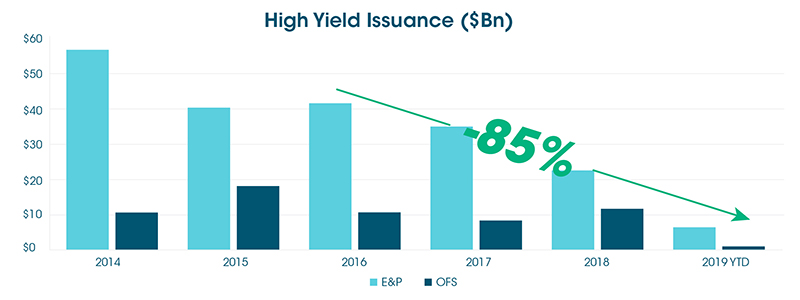

These changes have also led to compression of EBITDA multiples for oil and gas companies even as the industry learns to live within current oil prices. The chart below shows total E&P EBITDA growing from 2016, but even as companies generate more earnings, their enterprise value to EBITDA multiples have sunk well below levels seen in 2016.

Low multiples compound a company’s inability to raise new capital, and creates an opportunitiy for investment into the space. With historically low value being placed on assets in the oil and gas space, there is a great deal of upside available to investors who are able to acquire quality assets from companies that are having to allocate their finite capital to only select portion of their asset base.

Capital constraints across the industry provide generational opportunity for targeted investment. Companies are having to think creatively to raise capital for their operations have changed over the last three years, and the industry continues to find ways to fund operations. In this market private equity firms like Fulcrum Energy Capital Funds are uniquely positioned to continue to find new ways to provide returns for their limited partners.

To learn more about how the oil and gas industry is adapting, and about how Fulcrum is building value in this current environment, please review our market update.