Fulcrum takes a value-oriented approach to upstream investing, primarily creating value through active ownership and unique industry relationships. We seek to take sizeable positions in smaller oil and gas companies, enabling us to influence business strategy and operational efficiency through our in-house technical team. Investments are structured to maintain flexibility through varying market conditions, allowing us to hold investments over a medium-term horizon or exit opportunistically to maximize value for stakeholders.

OUR STRATEGY

Fulcrum believes in disciplined investing and concentrating on deep value opportunities.

Niche Focus

Pursuing the best investments available, within a segment of the market that is under-capitalized |

Ability to Price Risk

Investing across the capital structure where risk is mispriced |

Patient Investors

Approaching investments with a longer-term perspective to maximize value |

Prudently Timing The Market Cycle

Opportunistically investing capital when others have acted prematurely |

Value Orientation

Mitigating risk through fundamental analysis and sound judgment, not generic models |

Good Companies, Bad Balance Sheets

Identifying well-run businesses and assets with strong market positions constrained by over-leveraged capital structures |

Active Owners

Engaging with management to create value |

OUR APPROACH

Fulcrum believes in disciplined investing and concentrating on deep value opportunities.

Niche Focus

Pursuing the best investments available, within a segment of the market that is under-capitalized |

Value Orientation

Mitigating risk through fundamental analysis and sound judgment, not generic models |

Ability to Price Risk

Investing across the capital structure where risk is mispriced |

Good Companies, Bad Balance Sheets

Identifying well-run businesses and assets with strong market positions constrained by over-leveraged capital structures |

Patient Investors:

Approaching investments with a longer-term perspective to maximize value |

Active Owners:

Engaging with management to create value |

Prudently Timing The Market Cycle:

Opportunistically investing capital when others have acted prematurely |

Investment Criteria

Transaction Type

Hedges

After Investment

Finding Non-Marketed

Relationship Deals

Returning Cash Flow

to Investors

Sell After

~5 Years

- Ability to hedge-in a robust base return, with substantial downside protection

- Pursuing new financings in areas with little access to current capital markets

- Pursuing financings at valuations supported by producing reserves and current cash flow

- Non-marketed relationship deals

- Niche transactions in the distressed and special situations space

- Transactions where the majority of overall invested capital is returned through asset cash flow over a medium-term hold period

Transaction Size

Typical Fulcrum Investment

$10 – $25M

with exceptions

Transaction Values Typically Up to

$100M

for initial platform

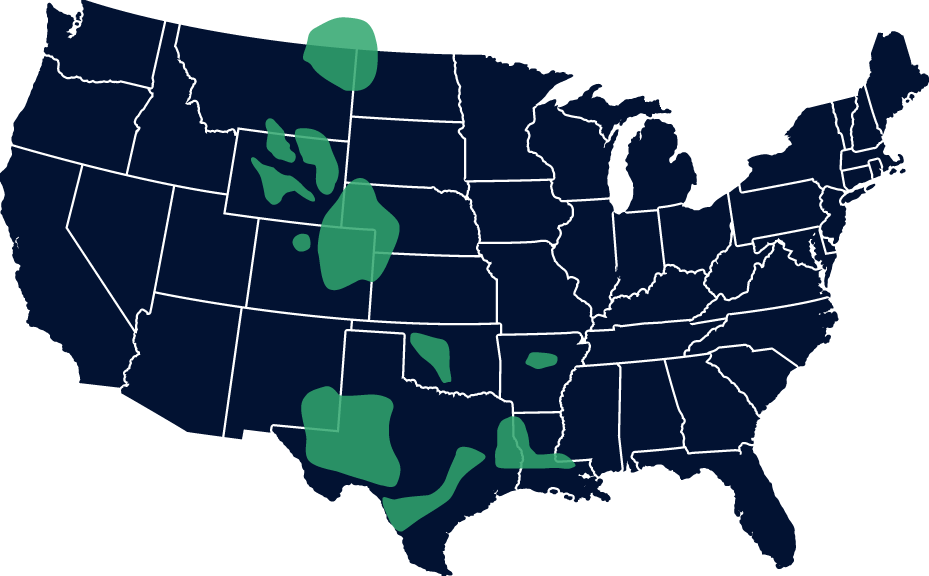

Opportunity Set

Underserved space in lower middle market oil and gas finance |

Capital intensive industry given asset heavy nature of the business |

Large wave of M&A, debt maturities, and capital requirements on the horizon |

Strategic situations where flexible capital solutions are differentiated and existing capital providers are too large and over-specialized |

Denver is an underserved market for energy private equity capital relative to the number of oil and gas companies in the Rocky Mountain region |

Other Key Criteria