23 Jul Oil and Gas Acquisition and Divestiture Market and Fulcrum Deal Pipeline Update

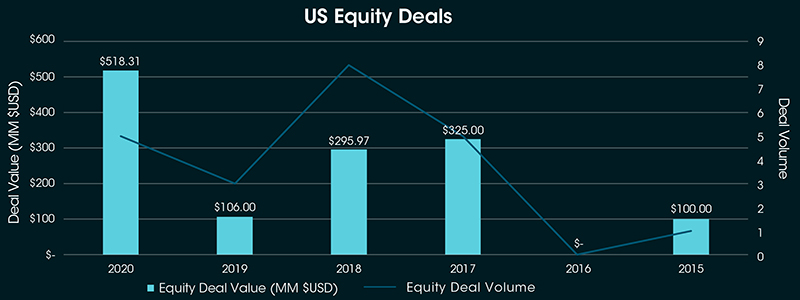

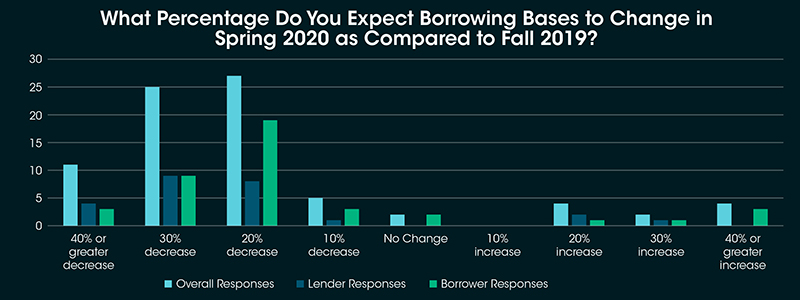

As mentioned in our Firm’s update memorandum circulated in Q1 2020, commodity prices have declined significantly along with the broader global market. Since Q1 2020, commodity prices have rebounded substantially with reduced supply and demand improving with the broader economy; however, oil and natural gas commodity pricing levels remain approximately 20% below pre-COVID-19 virus levels, and many oil and gas companies are experiencing significant financial distress largely as a result of overleveraged balance sheets. New oil and gas offerings have dropped since a peak in early-2018 due to commodity price volatility and market uncertainty, but Q1 2020 marked a distinct low in asset offerings as the market contended with commodity price shock and unprecedented investor pessimism towards the energy sector, even prior to global recession fears as a result of the COVID-19 virus. Announced transactions in Q1 2020 set a new benchmark for lack of A&D activity within the analyzed period. The current A&D environment is mostly concentrated on opportunistic acquisitions of distressed assets and corporate consolidations at bargain prices.

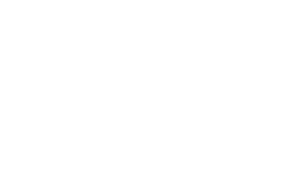

The divergence between the movements of spot prices and public equity performance demonstrates the weakened capital markets. Public companies have fundamentally ceased to participate in the A&D market except for select corporate consolidations. The unprecedented market sell-off in Q1 2020 demonstrated that public companies are challenged to protect their existing market capitalization, let alone issue additional stock for an acquisition. The sustained period of weakened capital markets indicates that the current market stance from public companies towards underdeveloped assets is likely a permanent shift. As public companies are not able to tap the capital markets to fund acquisitions, private equity sponsors have slowed investments in both backing new teams and in continued investment in existing teams via capital for drilling.

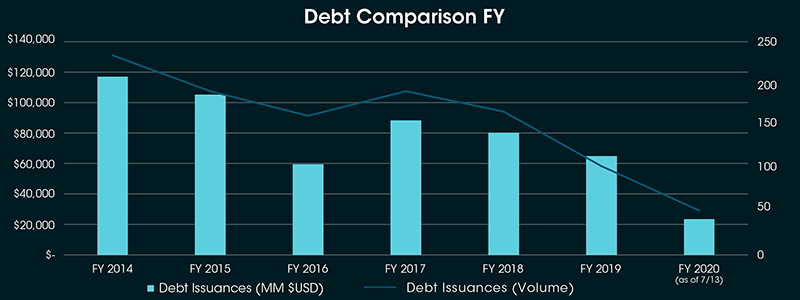

As a result of the significant consolidation in the oil and gas industry and financial distress present in the market, Fulcrum is seeing many attractive distressed investment opportunities and attractive corporate carve-out acquisitions. While A&D activity in the larger market has decreased, there is more liquidity in the <$50 million transaction space: Smaller transactions appear to be the first that are fire-sold by banks and larger companies, as the write downs are less substantial and such transactions provide an opportunity for larger companies to reduce corporate expenses as well as focus on assets where the majority of capital has been invested historically. The yields required by investors for High Yield Corporate Energy Bonds spiked in March due to the combined shock of OPEC/COVID, but have been compressed since due to the Fed lowering interest rates and purchasing non-investment grade bond ETFs (thereby pushing up prices for the underlying securities).

The yields required by investors for High Yield Corporate Energy Bonds spiked in March due to the combined shock of OPEC/COVID, but have been compressed since due to the Fed lowering interest rates and purchasing non-investment grade bond ETFs (thereby pushing up prices for the underlying securities).

As such, Fulcrum focuses primarily on the lower middle market on opportunities where assets are being liquidated out-of-court by commercial banks or via a Chapter 11 bankruptcy process. Based on transaction data, the market rarely rewards forced sellers of assets in a liquidation scenario compared to those sold via an orderly or consensual process. Fulcrum estimates a weighted average discount of 26% paid on a $ per daily flowing barrel of oil equivalent (boe) and a 45% discount paid on a $ per proven boe (little value for upside) for transactions sold via bankruptcy and foreclosure processes versus voluntary sales processes. Currently, many banks are working through forbearance periods on distressed credits and considering foreclosure given the modest improvement in commodity prices. Such assets are either being sold in a distressed context or alternative capital is coming in as a replacement for traditional reserved based loans to acquire distressed debt at a similar discount to what commercial banks would garner via bankruptcy. This space is where Fulcrum is focusing given the deep valuation discount and forced seller dynamic.

Fulcrum believes that we are currently in a very attractive asset acquisition market in the oil and gas sector, and the Firm believes the next twelve to eighteen months will be one of the best times in history to acquire quality oil and gas assets at historically low valuations from forced sellers with overleveraged balance sheets. New acquisitions and accretive add-on acquisitions will be a large focus for the Firm in the near to medium term as our current deal pipeline (over 10 potential transactions with an average deal size of approximately $10 – $25 million) over continues to grow and we convert more of the pipeline to closed investments.